FVANNUITY( ) function

Returns the future value of a series of payments calculated using a constant interest rate. Future value is the sum of the payments plus the accumulated compound interest.

Syntax

FVANNUITY(rate, periods, payment <,type>)

Parameters

| Name | Type | Description |

|---|---|---|

| rate | numeric |

The interest rate per period. |

| periods | numeric |

The total number of payment periods. |

| payment | numeric |

The payment per period. The payment amount must remain constant over the term of the annuity. |

|

type optional |

numeric |

The timing of payments:

If omitted, the default value of 0 is used. |

Note

You must use consistent time periods when specifying rate, periods, and payment to ensure that you are specifying interest rate per period.

For example:

- for a monthly payment on a two-year loan or investment with interest of 5% per annum, specify 0.05/12 for rate and 2 * 12 for periods

- for an annual payment on the same loan or investment, specify 0.05 for rate and 2 for periods

Output

Numeric. The result is calculated to two decimal places.

Examples

Basic examples

Monthly payments

Returns 27243.20, the future value of $1,000 paid at the beginning of each month for 2 years at 1% per month, compounded monthly:

FVANNUITY(0.01, 2*12, 1000, 1)

Returns 12809.33, the future value of the same annuity after the first year:

FVANNUITY(0.01, 12, 1000, 1)

Annual payments

Returns 25440.00, the future value of $12,000 paid at the end of each year for 2 years at 12% per annum, compounded annually:

FVANNUITY(0.12, 2, 12000, 0)

Advanced examples

Annuity calculations

Annuity calculations involve four variables:

- present value, or future value $21,243.39 and $ 26,973.46 in the examples below

- payment amount per period $1,000.00 in the examples below

- interest rate per period 1% per month in the examples below

- number of periods 24 months in the examples below

If you know the value of three of the variables, you can use an Analytics function to calculate the fourth.

| I want to find: | Analytics function to use: |

|---|---|

| Present value |

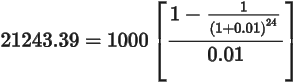

PVANNUITY( ) Returns 21243.39: PVANNUITY(0.01, 24, 1000) |

| Future value |

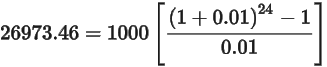

FVANNUITY( ) Returns 26973.46: FVANNUITY(0.01, 24, 1000) |

| Payment amount per period |

PMT( ) Returns 1000: PMT(0.01, 24, 21243.39) |

| Interest rate per period |

RATE( ) Returns 0.00999999 (1%): RATE(24, 1000, 21243.39) |

| Number of periods |

NPER( ) Returns 24.00: NPER(0.01, 1000, 21243.39) |

Annuity formulas

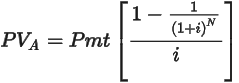

The formula for calculating the present value of an ordinary annuity (payment at the end of a period):

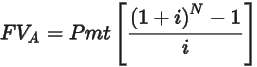

The formula for calculating the future value of an ordinary annuity (payment at the end of a period):

Remarks

Related functions

The PVANNUITY( ) function is the inverse of the FVANNUITY( ) function.