You want to discover the rate of deviation from a prescribed control, or the total amount of monetary misstatement, in an account or class of transactions. However, you may not have the time or the budget to examine every record in the data set.

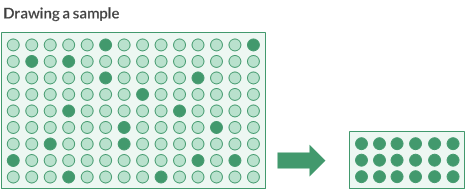

You can use Analytics to draw a statistically valid subset of the data, called a sample, and analyze this much smaller set of data instead.

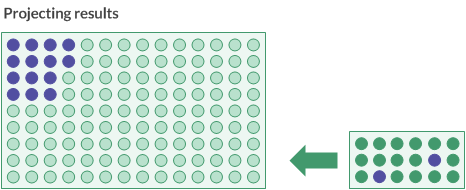

You can then project the results you get from analyzing the smaller set of data to the entire population of data. The projection creates an estimate of the overall deviation rate, or the overall amount of misstatement.

The sample selection and the projection use statistical formulas, which ensure a reasonable and measurable degree of confidence that the estimate is close to what you would have got if you had actually examined every record.

Note

The information about sampling in this guide is intended to help users already familiar with audit sampling perform sampling tasks in Analytics. The information is not intended to explain audit sampling theory, which is a complex subject.

For in-depth coverage of audit sampling, consult a resource such as AICPA's Audit Guide: Audit Sampling.

Sampling types

Analytics has three types of sampling:

- record sampling (attributes sampling)

- monetary unit sampling

- classical variables sampling

The type of sampling you choose depends on the nature of the analysis you are doing, and the nature of the data.

Sampling in Analytics is statistical sampling

Sampling in Analytics is statistical sampling. A sample drawn by Analytics is statistically valid, or representative, because it is planned, drawn, and evaluated using accepted statistical formulas.

The formulas are based on probability distributions. Record sampling and monetary unit sampling are based on the Poisson distribution, and classical variables sampling is based on the normal distribution.

Which type of sampling should I use?

The table below provides guidelines about choosing the type of sampling to use.

Note

If all you require is a non-representative random selection of records, see Generate a random selection of records. Projecting results based on a non-representative selection has no statistical validity.

| Sampling type | Use if: |

|---|---|

|

You are testing controls. Record sampling is appropriate if you are auditing the rate of deviation from a prescribed control. If your analysis will yield a yes/no or pass/fail result for each record being analyzed then you should use record sampling. |

|

|

You are analyzing an account or class of transactions for monetary misstatement, and you expect the financial data to have the following characteristics:

|

|

|

You are analyzing an account or class of transactions for monetary misstatement, and you expect the financial data to have the following characteristics:

|

Sampling involves professional judgment

The sampling features in Analytics automate a number of the calculations and processes involved in audit sampling. However, reliable and effective sampling also requires that you apply professional judgment in several areas.

Note

If you are not familiar with the professional judgments required to perform audit sampling in a reliable manner, we recommend that you consult audit sampling resources, or an audit sampling specialist, before using Analytics for sampling in a production environment.

| Area | Required judgment |

|---|---|

| Confidence | assessing the required degree of confidence that a sample is representative |

|

Materiality Monetary precision |

deciding upon the acceptable level of misstatement in an account or class of transactions |

| Tolerable deviation rate | deciding upon the acceptable rate of deviation from a prescribed control |

| Selection method | choosing an appropriate sample selection method |

| Evaluation method | for classical variables sampling, choosing an appropriate evaluation method |

A word about terminology

To help those less familiar with audit sampling, several terms that appear in this guide are defined very simply below.

Note

These are layperson definitions that intentionally simplify the more precise definitions used in the audit and assurance profession.

| control |

A mandated process that provides assurance. For example: all vouchers must be approved and signed by a manager. |

|---|---|

| deviation, control deviation |

A failure to comply with a control. For example: a voucher was processed without a manager's signature. |

| misstatement | An inaccurate number – typically, an inaccurate monetary amount. |

| materiality | The point at which something becomes significant. |

| material misstatement |

An inaccuracy that is large enough to matter. Can refer to a single number, or to an entire account, as in: "The account is materially misstated". |

| population | The entire set of records in a file, or the entire monetary amount in an account or class of transactions, from which a sample is drawn. |

| project | To estimate; to extrapolate an unknown value based on an observed value or values. |

| representative | Having the same characteristics as the larger group. |

| sampling, sample | A statistically valid process that selects less than 100% of a population. This subset is known as "the sample". |

| seed | A number that you specify, or that Analytics randomly selects, to initialize the Analytics random number generator. |

| tainting |

In a misstated amount, the percentage of the book value (recorded value) that the misstatement represents. For example: a $200 book value that should actually be $180 is misstated by $20 and therefore has a 10% tainting. |

| tolerable | Acceptable; within the bounds of acceptability. |

| universe | Another term for "population". |

Analytics terms versus industry terms

A number of the labels on the sampling dialog boxes in Analytics use Analytics terms. You may find the terms disorienting if you already understand audit sampling and the associated terminology. For a mapping of Analytics terms to industry terms, see Audit sampling terminology.