Assessing and visualizing risks

Strategy is an app in Diligent One. You can follow this quick start to learn how to assess and visualize risks in the Strategy app.

Before you start

You should complete Building a risk profile and defining risks, have a basic understanding of Strategy and other Diligent One apps, and/or have relevant domain knowledge.

Workflow

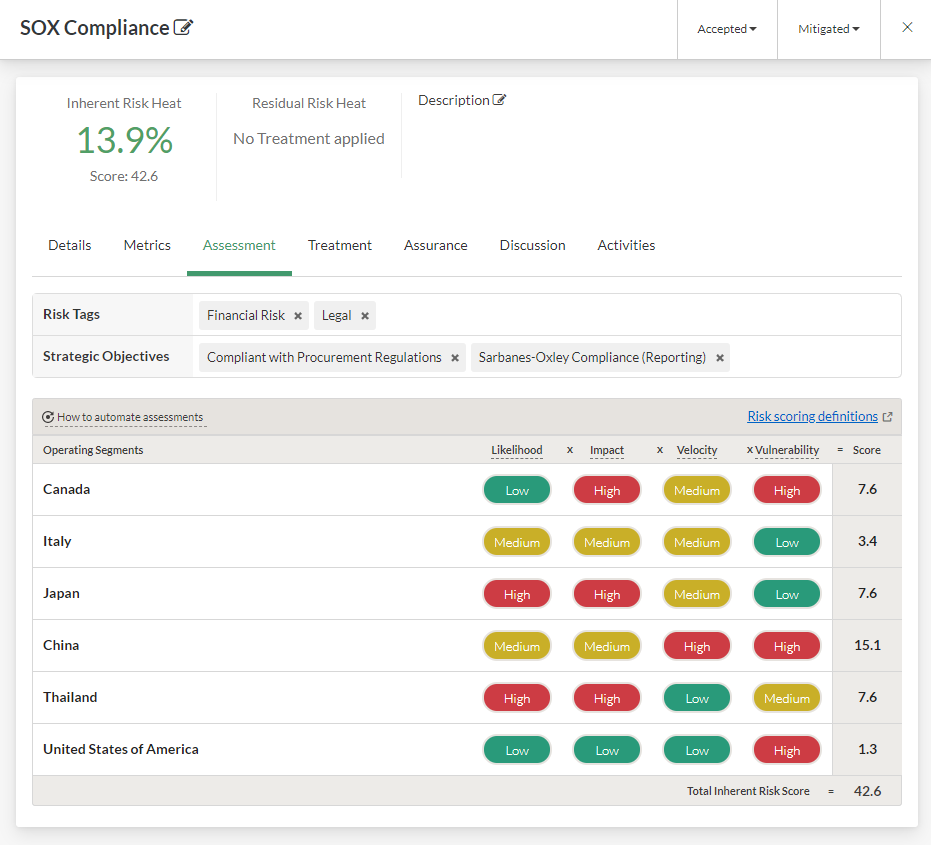

1. Assess inherent risk

-

From the Platform home page (www.diligentoneplatform.com), select the Strategy app to open it.

If you are already in Diligent One, you can use the left-hand navigation menu to switch to the Strategy app.

Note

Diligent One Platform also supports the domain www.highbond.com. For more information, see Supported domains.

- Click the appropriate risk name.

- Click the Assessment tab if you are not already on it.

- Specify a score using the 3, 5, 10 point or custom scale configured for your organization to assess the risk across operating segments.

- Repeat steps 6 and 7 for each risk scoring factor.

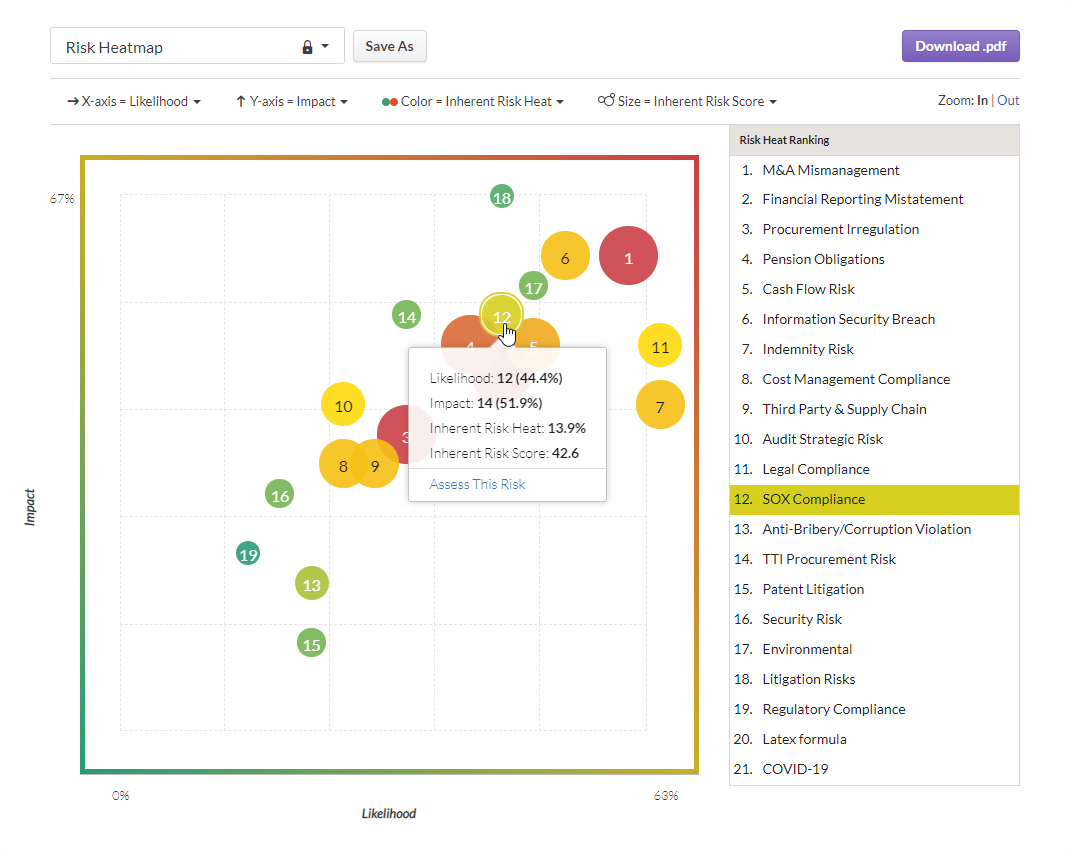

2. Visualize risks

- Select Heatmaps in the main navigation menu.

- Do any of the following:

- Select Strategy Heatmap to view organizational risks or download a PDF version of the Strategy Map:

- Select a Risk Heatmap to view or configure a Risk Heatmap or download a PDF version of the Risk Heatmap:

- Select Strategy Heatmap to view organizational risks or download a PDF version of the Strategy Map:

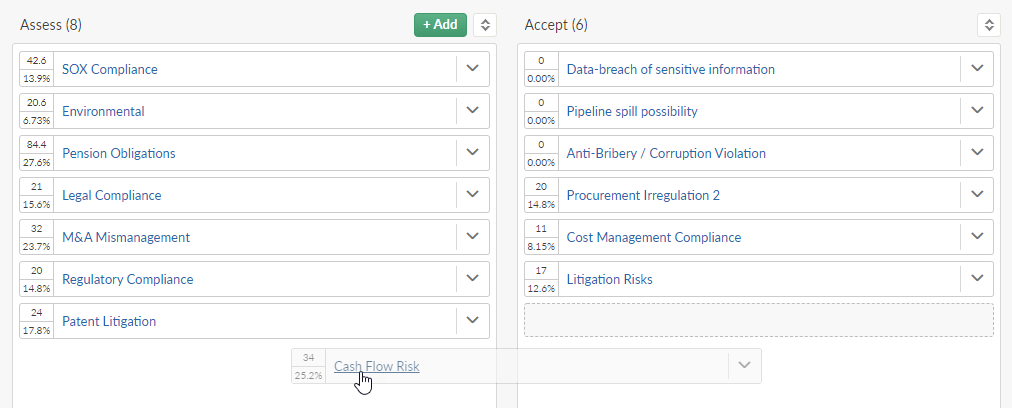

3. Assign a risk to a state

Click and drag the risk tile to the new location.

What to do next

Link metrics to risks, associate risks with treatments, assess residual risk, and view assurance: Integrating data to monitor risks